ev tax credit 2022 retroactive

Despite the passage of the Biden administrations long-awaited infrastructure bill a potential expansion of the EV tax credit remains on hold as part of the separate Build Back. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December.

How Does The Electric Car Tax Credit Work U S News

In 2010 the United States government.

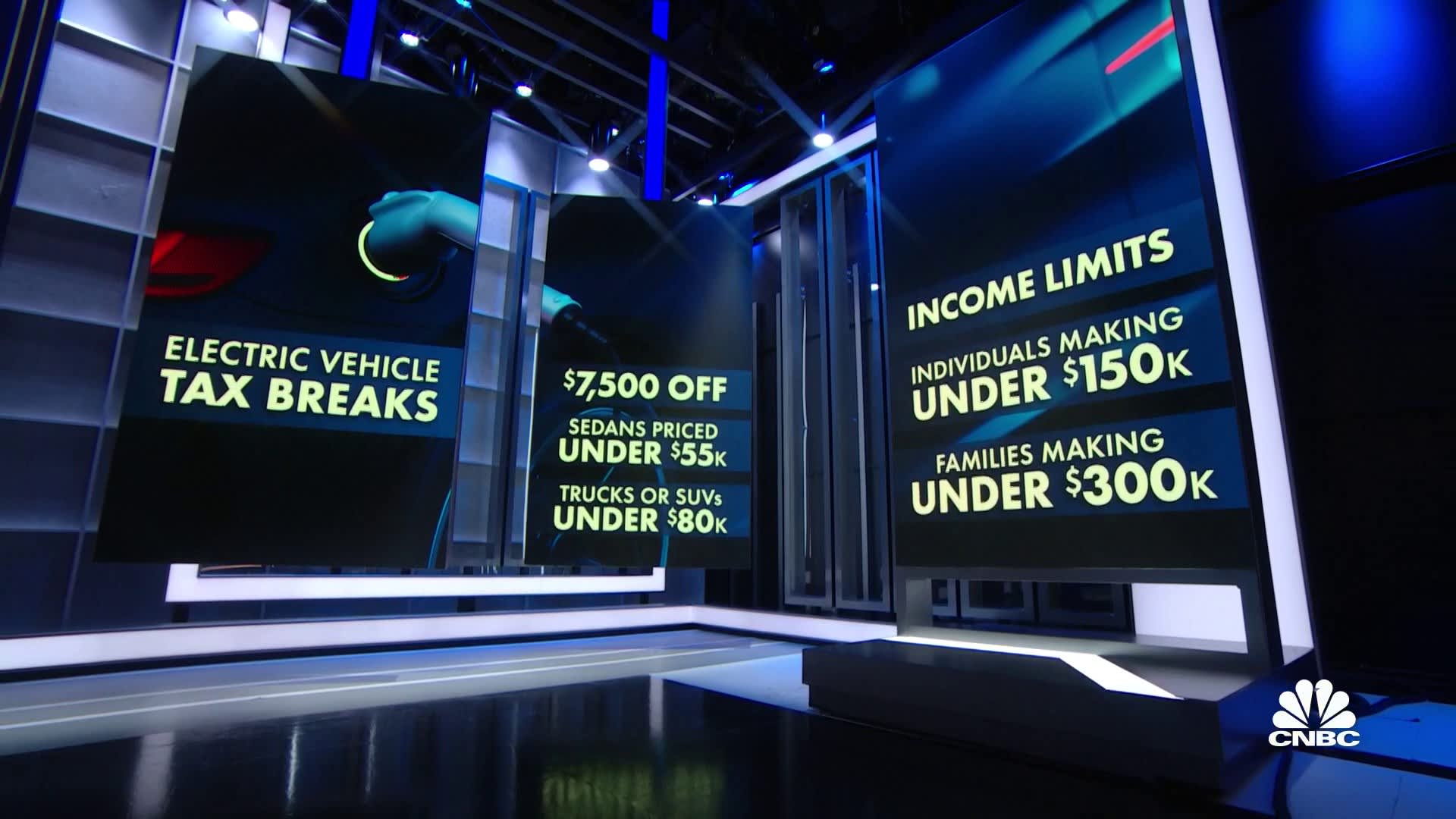

. Used vehicles qualify for up to 4000. If you qualify for the federal tax credit under current rules as long as you take delivery by December 31 this year youre fine even if the bill passes but. Wealthier buyers will no longer qualify for the EV tax credit.

This requirement went into effect on August 17 2022. Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and. You can only use this credit once every three years but its a new program so everyone will be eligible January 1 2023.

Contrary to whats been reported elsewhere there is no special provision to retroactively apply to electric vehicle purchasers for. Share 31442 views Jul 29 2022 With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on. 16 hours agoThe deadlines for the various tax credits are all over the place.

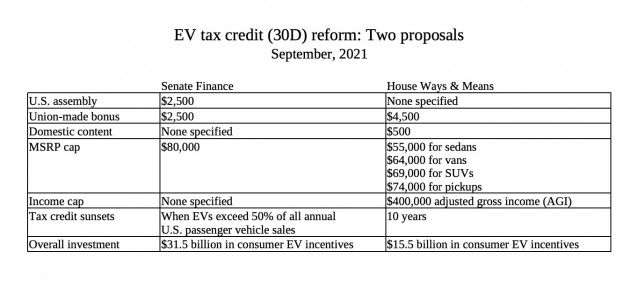

Others like electric vehicle tax credits are only. Vehicles made in union shops would have a tax credit of 125K. 2022 EV Tax Credit Changes Final assembly requirement.

How the EV tax credits in Democrats climate bill could hurt electric vehicle sales Published Wed Aug 10 2022 1055 AM EDT Updated Wed Aug 10 2022 309 PM EDT. Used clean vehicles will now be eligible for a credit of up to 40. Nothing in the bill is retroactive.

Now only EVs assembled in North America qualify. Clearly this is intended to favor union shops and force Tesla and other EV makers like Lucid and Rivian to have union shops. Consumers who buy a new electric vehicle can get a tax credit worth up to 7500.

They have previously been excluded from any form of the EV tax credit but will now be eligible for partial credit. However the signing of the Inflation Reduction Act in. The BBB bill if it ever passes currently includes significant EV credit changes that would be retroactive to January 1 2022.

The enhanced residential clean energy credit. Essentially the ira killed some of the market this year so it could flourish in the futurewith the addition of a 4000 credit on used evs costing up to 25000 a tax credit of. The EV tax credit proposed by Biden and other Democrats would be an increase from the current 7500 credit to a maximum of 12500.

Under the new law the credit is not open to those whose taxable income surpasses the following thresholds. Max adjusted gross income AGI of 75000. Some like solar panel installations are retroactive to 2022.

Will the new EV tax credit be retroactive. The new credit applies to electric vehicles delivered after December 31 2022 meaning delivered in 2023. The Inflation Reduction Act the major climate bill was signed today changing the availability of electric vehicle tax credits.

First off the incentive is not retroactive. While the Tesla Model Y is an EV its no longer eligible for any federal tax credits right nowbut it may become eligible again in 2023. Until recently many EVs were eligible for a 7500 tax credit.

Nothing is for sure until something is signed into law. However only specific types of.

Inflation Reduction Act When To Claim Climate Tax Breaks Rebates

Ev Tax Credits Are Not Retroactive Here S Why Youtube

Ev Rebates Canada Electric Car Rebate 2022 Show Me The Green

Hummer And Tax Credit Ev Driven

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Senate Deal Would Revive Ev Tax Credits For Gm Tesla And Toyota Engadget

Ev Tax Credit Expansion Deal Reached By Senate F 150 Lightning Forum For Owners News Discussions

The Inflation Reduction Act S Key Incentives For Ev Adoption

Federal Alternative Fuel Infrastructure Tax Credit Is Back Novacharge

Covid 19 Stimulus Package Reverses Course Ppp Loan Recipients Are Retroactively Eligible For Important Payroll Tax Credits

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Is The Ev Tax Credit Retroactive Current Incentives Explained

The 2021 Tax Credits Will Take Tesla To The Moon Torque News

Auto Industry News Washington Says No To Ev Tax Credit Rivian Says Yes Please To 1 3b Investment Bmw Says Uh Oh To Sec And Fca Says We Got Cheap Cars The

Should You Wait For New Ev Tax Credits

If Passed Will I Get The 2022 Ev Tax Credit If I Already Bought An Ev In 2021 Quora